October/November 2025 marked a period of intensified border hostilities between Pakistan and Afghanistan, raising questions about Washington's regional influence and strategic priorities. While the United States maintained diplomatic engagement with both Islamabad and Kabul through separate channels—including ongoing negotiations over American detainees and expanding economic partnerships—its role in mediating the immediate crisis remained limited. Regional actors including Qatar, Turkey, and Saudi Arabia assumed primary responsibility for brokering ceasefires, highlighting the evolving landscape of South Asian security dynamics. Concurrently, the Trump administration's domestic immigration enforcement policies intersected with its foreign policy commitments, as Afghan allies who had served U.S. forces faced detention despite lacking criminal charges. October also witnessed the operationalization of the U.S.-Pakistan critical minerals partnership, with the first shipment of rare earth elements, underscoring Washington's strategic pivot toward economic engagement with Islamabad.

U.S.-Pakistan Strategic Partnership: Economic and Defense Deepening

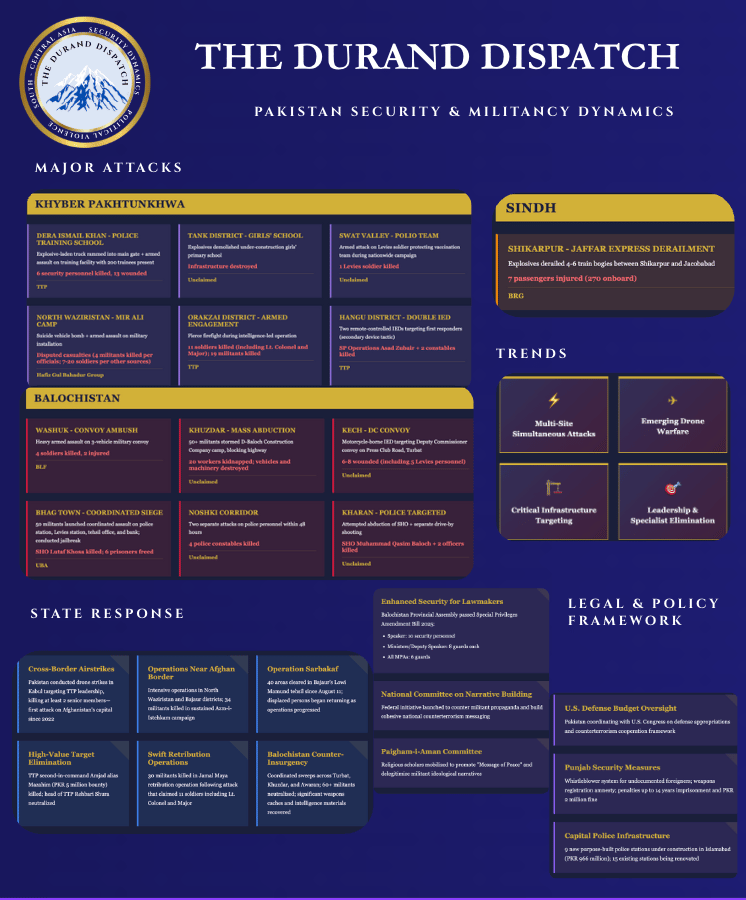

Border Hostilities and U.S. Positioning In recent weeks, Pakistan and Afghanistan engaged in a series of armed clashes along their shared border, prompted by Islamabad's accusation that the Taliban provides support for insurgencies operating within Pakistan. President Trump floated the possibility of U.S. intervention, stating that he might attempt to mediate and bring peace to the conflict. The President later expanded on this position, stating that he knew both sides well and would address the situation quickly, claiming it would represent yet another conflict resolved by his administration. The exact mechanisms or timeline for such intervention, however, remained undefined. The State Department stated that the U.S. continues to monitor the situation closely, while the White House cited what it termed the "democrat shutdown" as a factor in its delayed response to the violence between the two countries. This response pattern reflected Washington's broader approach: observation and political positioning rather than direct diplomatic or security intervention. The U.S. had been increasing its collaboration with both countries through separate bilateral channels—the Trump administration sought improved diplomatic relations with the Taliban in exchange for the release of U.S. detainees, while simultaneously signing economic cooperation agreements with Pakistan and making verbal commitments to enhance counterterrorism collaboration.The October border crisis exposed the constraints of recent U.S. strategic engagement in Central Asia, which has prioritized broader regional economic interests over direct conflict resolution or sustained security enforcement. Washington remained largely absent from key negotiation processes in Qatar and Istanbul, despite recent diplomatic efforts with Pakistan and the Taliban through channels such as hostage negotiations in Afghanistan. The administration had also cultivated what sources described as an unusually cordial relationship with Pakistan's Chief of Army Staff Field Marshal Asim Munir following U.S. mediatory efforts during the May 2025 India-Pakistan conflict. In early November, President Trump reiterated his willingness to intervene in the Pakistan-Afghanistan crisis, telling reporters on the sidelines of the ASEAN Summit in Malaysia that he would "solve the Afghanistan-Pakistan crisis very quickly."

U.S.-Pakistan Economic Cooperation: Critical Minerals Partnership Pakistan shipped its first batch of enriched rare earth metals to U.S. Strategic Metals (USSM) on October 2. This marked the first shipment under a $500 million agreement between the two countries for the partnership to develop Pakistan's rare earth elements and critical minerals sector as part of a phased plan: Phase 1 (2025–2026) focuses on exporting readily available minerals, including antimony, copper concentrates, and basic rare earth ores, to generate early revenue. Phase 2 (2026–2028) involves establishing domestic processing plants and refineries, incorporating technology transfer for rare earth element (REE) separation and purification. Phase 3 (2028 and beyond) aims for large-scale exploration and mining, targeting five to ten high-potential REE projects across Pakistan. U.S. officials framed the shipment as an important first step in meeting these objectives. The CEO of USSM echoed this sentiment, stating: "We see this as the first step in our exciting journey together with the Frontier Works Organisation of Pakistan, to provide critical minerals to the United States and bolster economic trade and friendship between our two countries." This arrangement effectively establishes an alternative supply channel for critical metals embedded in advanced U.S. defense systems. In doing so, it mitigates the strategic vulnerability associated with potential Chinese supply disruptions, helping ensure the continued operability of American fighter aircraft, submarines, night-vision technologies, and precision-guided munitions. This includes the establishment of a strategically important non-Chinese supply chain for neodymium, praseodymium, antimony, and high-purity copper—materials the U.S. Department of Defense classifies as 'Tier-1' operational risks due to China's control of over 90% of global rare-earth processing and its 2024 export restrictions of critical minerals to the United States.

Security Challenges to Partnership Viability With Balochistan and Khyber Pakhtunkhwa hosting the bulk of identified Rare Earth Elements (REE) copper, and antimony deposits, the risks to refinement projects from militant activities in these areas remain substantial. The BLA has conducted several attacks on mining and infrastructure projects since 2018, targeting foreign workers and convoys. Chinese nationals, deeply embedded in projects like Reko Diq and Saindak, have been primary victims. The Reko Diq project alone requires $13–14 million annually in security costs, including private militias and military escorts. TTP attacks on infrastructure and security forces in Swat, Dir, and the tribal districts threaten northern REE prospects (e.g., pegmatite deposits with up to 3,300 ppm total rare earth oxides). Road access to these sites passes through areas where TTP maintains presence, rendering logistics highly vulnerable. With thousands of Chinese nationals already in Pakistan (many in mining), any U.S.-led expansion risks mirroring or escalating anti-foreign sentiment. Insurgents view such projects as symbols of external exploitation, especially when tied to military or state entities like the Frontier Works Organisation (FWO). Without substantial, sustained counterinsurgency gains and addressed local grievances (e.g., revenue sharing, employment opportunities), security costs will likely remain elevated—potentially compounding project expenses and deterring investment.

Potential U.S. Government Support Mechanisms Potential funding support through the Defense Production Act, Title III, could complement the Pakistan partnership by providing a mechanism to expand critical-mineral capacity. Under DPA Title III, the Department of Defense has authority to issue grants, loans, and purchase commitments to encourage development of essential industrial capabilities. While no formal allocation for Pakistan has been announced, similar funding has historically been applied to boost private-sector financing in critical material production to counter the effects of Chinese monopolization. In the context of the U.S.–Pakistan agreement, DPA Title III could, in principle, help accelerate Phase 2 objectives such as REE separation, antimony refining, and associated logistics infrastructure, supporting broader U.S. supply-chain resilience goals for the defense sector, outlined in Executive Order 14017.

Domestic Political Opposition and Reserve Estimates Pakistan's lead opposition party (PTI) has criticized the agreement for allegedly having secretive terms and opposed the military's deep entrenchment in the deal. Additionally, while Pakistan claims $6 trillion in mineral wealth, these reserves are largely unproven. Proven reserves, such as those at Reko Diq in Balochistan, are reportedly worth roughly $60–74 billion, with valuations of total mineral wealth estimated at $100–300 billion over several decades.

China Factor and Strategic Limitations There remains considerable debate over whether U.S. efforts to deepen economic ties with Pakistan—especially in critical minerals—can truly counterbalance China's entrenched influence. Although the U.S.–Pakistan rare earths initiative appears strategically noteworthy, Pakistan remains closely aligned with Beijing. China's investments in Pakistan, under the China–Pakistan Economic Corridor, dwarf U.S. involvement, especially in mining and infrastructure. Pakistan has a long history of collaboration with Chinese firms, with China reportedly having invested $2 billion in Pakistan's mining sector, with a further $7 billion planned for Balochistan's Reko Diq mine. Moreover, in recent remarks, a Chinese Foreign Ministry spokesperson stated that Islamabad "kept Beijing in the loop" about its mining cooperation with the U.S., emphasizing that Pakistan's interactions would "never harm China's interests or its cooperation with China."

Pakistan Naval Chief's Washington Visit Pakistan's naval chief, Admiral Naveed Asraf, met with U.S. military leaders to discuss increasing defense cooperation between the two countries. Asraf met with think tank leaders, State Department officials, and the president of the National Defense University to discuss enduring cooperation on matters of mutual interest. This visit continues the trend of improved relations in matters of defense and economics between the countries. The recent improvement in relations has been received with some consternation in India. In response to Indian concerns, Secretary of State Marco Rubio made clear that he did not view this improvement in relations as coming at India's expense.

Pasni Port Infrastructure Proposal Pakistan allegedly proposed U.S. development of a commercial port in Pasni, Balochistan, during October. Valued at an estimated $1.2 billion, the investment would focus on port and rail connectivity to mineral-rich regions and would allegedly not be intended as a military base, but purely for commercial mineral exports. Pakistan has denied that any official offer was made, stating that any talks that occurred were merely exploratory. If this project were to materialize, it could alienate China, which is already involved in Balochistan's minerals sector and has developed a port at Gwadar in the region. The U.S. would also likely face the same security challenges from groups like the Balochistan Liberation Army that have hindered Chinese-led development efforts.

U.S.-Afghanistan Relations: Immigration Enforcement and Broken Promises

U.S. Immigration Enforcement and Afghan Allies The Detention of Mohammed Ali Dafdar Mohammed Ali Dafdar, an Afghan security official who worked alongside U.S. forces until the fall of Kabul in 2021, fled Afghanistan fearing for his family's safety and later settled in Colorado after applying for asylum. In October, he was detained in what ICE described as 'Operation Midway Blitz,' forcibly stripped, and placed in a detention center in Missouri. Homeland Security Secretary Kristi Noem hailed the operation as a success, claiming many of those detained had ties to criminal networks. However, Dafdar faces no criminal charges and remains in custody. The incident occurred amid sharp cuts to resettlement programs under the Trump administration, which contributed to a two-thirds decline in arrivals of Afghan refugees fleeing Taliban persecution. The detention highlights broader questions regarding U.S. immigration and refugee policy. The case also provides further evidence of increasingly aggressive tactics employed by ICE enforcement operations amid an increasingly restrictive immigration policy environment.

Taliban's Broken Amnesty Promises A report in the Air Force Times illustrated the false nature of Taliban promises of amnesty to Afghans returning from overseas. Since 2023, the Taliban have allegedly executed over 100 former members of the Afghan national defense forces, though this number is likely an undercount due to the climate of fear created by the regime. The Trump administration's decision earlier in 2025 to end temporary protection status for 9,000 Afghan refugees living in the United States, combined with the January suspension of refugee admissions, has closed pathways to safety for Afghans both within and outside the country.

The Gold standard for AI news

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team